I have seen many queries on whether AdMob Developers Need to Add GSTIN For Paid apps in Play Store. If you recently signed up for a Google play developer account and try to figure out how and why you need to GSTIN, you may need to read this post.

I have seen many queries on whether AdMob Developers Need to Add GSTIN For Paid apps in Play Store. If you recently signed up for a Google play developer account and try to figure out how and why you need to GSTIN, you may need to read this post.

Why Should I pay GST?

As per theGST rules,Government will specify categories of services the tax onintra-State suppliesof which shall be paid by the electronic commerce operator if such services are supplied through it.We have to register for GST when we do inter-state sales(Residing in one state and selling products in other states) even if you are not crossing the Rs.20 lakhs revenue per year.

I am Individual Developer. Why Do I Need to add GSTIN?

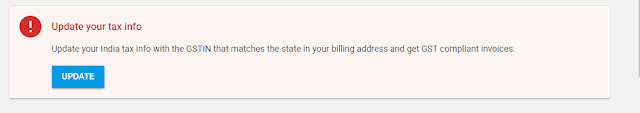

Goods and Services Tax Identification Number (GSTINs) are mandatory for business accounts, but optional for individual accounts. However if you are an individual developer and do not own a business, you need to add GSTIN in admob. This is because you are doing interstate sales through in app purchases.

|

| gst add notification an ad mob account |

If you do not add GSTIN to the individual account, you will be charged integrated taxes as per Google.

I have a business account but I am a Individual Developer. Do I Need to add GSTIN?

If you have a business account, you must add GSTIN as it it compulsory to pay taxes for digital ads and services.

If you are in Special Economic Zone, you need toset “SEZ” as the tax status and upload SEZ certificate.

I display ads in applications? Do I need to add GSTIN?

I have written a detailed post on that.Solved: Update your India tax info with the GSTIN that matches the state in your billing address

What are the current Tax Rates?

Integrated GST rate: 18%

Central GST rate: 9%

State GST rate: 9%

Haryana customers are charged CGST 9% + SGST (9%)

SEZ customers are charged GST 0%

All other states, customers are charged IGST 18%

How much is current rate of TDS for advertising-related payments

Current rate of TDS is 2% excluding Service Tax and education cesses (per Circular No. 1/2014 issued by the Central Board of Direct Taxes, Ministry of Finance, Govt of India))

Sources:

AdMob Developers Must Add GSTIN For Mobile Applications in PlayStore

Responsibilities of Government of India Under GST Act to Tax Payers

GST (Goods and Services Tax) on purchases in India, Google Support

Taxes in your country, Google Support

Update 8 September 2017

Publishers who have less than 20 lakhs of income do not need to pay or register for GST even if they are doing Interstate sales.