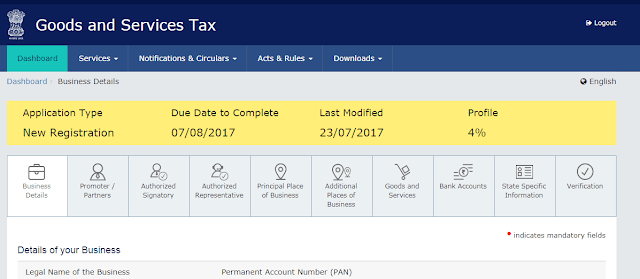

This guide will discuss each part of GSTIN registration in detail and in less complicated manner. GSTIN PART B Registration has 10 sub parts to do.

- Business Details

- Promoter / Partners

- Authorized Signatory

- Authorized Representative

- Principal Place of Business

- Additional Places of Business

- Goods and Services

- Bank Accounts

- State Specific Information

- Verification

Trade Name

Constitution of Business (Select Appropriate)

- Foreign company

- Foreign limited liability Partnership

- Government department

- Hindu Undivided Family

- Limited liability Partnership

- Local Authority

- Others

- Partnership

- Private Limited Company

- Proprietorship – If the PAN Card is of an individual and have sole proprietorship, then you can choose this option. Individual Ad Mob developers should also choose this.

- Public Limited Company

- Public Sector Undertaking

- Society / Club / Trust / AOP – AOP is Apartment owners association. If the annual maintenance charge collected from members is more than Rs.60000 per annum or more than Rs,5000 per month, then AOP need to register under GST and collect GST 18%. Source: caclubindia

- Statutory Body

- Unlimited Company

Demographic Details

Are you applying for registration as a casual taxable person?

Certificate of registration issued to a casual taxable person will be valid for a period of 90 days. Kindly read more on Casual Taxable person in Cleartax website.

Option For Composition

Following Taxpayers Canot opt for Composition scheme

a. Casual Taxable Person

b. Person opted for ISD only

c. Another px payer or application for registration exists exists with same PAN but not opted for composition

d. Reason for registration is for Interstate supply

e. Reason for registration is supplying goods through E-commerce operator

f. Person who has not filled any goods in details of Top 5 goods dealing in.

g. Reason for registration is SEZ unit ot SEZ developer

If you opt for composition scheme, you need to tick the box of “I hereby declare that the aforesaid business shall abide by the conditions and restrictions specified in the Act or Rules for opting to pay tax under the composition Levy. Important! Select the check box to accept the declaration”

You also need to select appropriate reason to obtain registration depending on whether you opted for composition. Kindly read more onOption for Composition in Cleartax website.

Reason to obtain registration

For Individual business or sole Proprietorship, you can choose Voluntary basis.

Add Date of commencement of Business.

Indicate Existing Registrations

If you have any existing Registrations as per the list, enter Registration Number and Date of Registration.

Select Save and Continue.

Business details submission completed.

You will see a mail from respective state Government as per below;

Dear Applicant/ Taxpayer,

This is with reference to the Application for New Registration & GST REG-01. Your Form has been saved in the GST System for 15 days. You can retrieve the saved Form by accessing through link “My Saved Applications”.

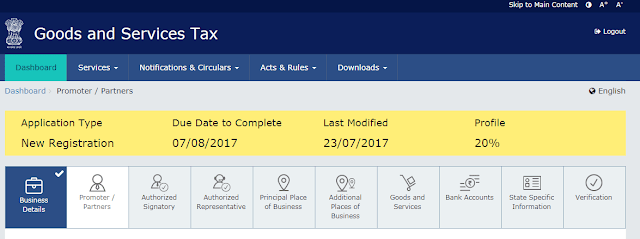

Now you can go ahead with fillingPromoter / Partners.

Share the post for others.